Note: This week’s Upstream is with Balaji Srinivasan. We cover his past and future predictions (not the bet!), the future for the left and right, and why tech can’t escape politics.

This week’s Moment of Zen is an AI “pause” debate with Nathan Labenz, Flo Crivello, and Anton Troynikov.

This week’s Cognitive Revolution is a deep dive into GPT4 with Nathan Labenz.

Disclaimer: I don’t know much about macro. Do let me know if I’ve made any incorrect points or if you disagree with any of the claims.

Balaji has recently made waves again by predicting that Bitcoin will hit $1M in 90 days. Bitcoin has been hovering around $28 and the possibility of it 60x’ing within 3 months seems highly unlikely.

Balaji admits he’s going to lose $1M, so his bet was not about making money. Balaji compares it to the famous Simon-Erlich wager where it was done mostly to draw attention to an issue, in Balaji’s case the fragility of the U.S. financial system. Let’s unpack his argument as well as some pushback to it.

To make sure I’m getting his argument right, I’ll quote from some of Balaji’s more prominent tweets:

It's Uncle Sam Bankman Fried. Just like SBF used your deposits to buy shitcoins, using accounting tricks to fool himself and others into using the money, so too did the banks.

They all used the deposits to buy the ultimate shitcoin: long-dated US Treasuries. And they all got rekt at the same time, in the same way, because they bought the same asset from the same vendor who devalued it at the same time: the Fed.

Specifically, as NYT admitted, banks "binged" on enormous amounts of Treasuries and other long-term bonds in 2021 when the flood of printed money cut off their typical demand for loans, and because they thought the Fed would keep interest rates low forever.

And they had good reason to believe this. Powell said he'd be "patient" on rate hikes as late as Nov 3 2021. Then he got renominated on Nov 22 2021, and hiked rates much faster than anyone had expected — which even Yellen and the FDIC admit caused the current banking crisis.

Why did Powell delay? Probably for political reasons. Presidents don't like rate hikes especially running into the election year of 2022. And Powell thought he could wait and just be like Paul Volcker, who was "firm" and then defeated inflation.

Just as in 2008, the bankers lied.

This time, the central bankers, the banks, and the bank regulators have lied to all dollar holders and depositors.

FTX balance sheet is like US bank balance sheets. Assets valued on what they were bought for, not what they can be sold for.

This isn't your typical fractional reserve situation. The problem is that there isn't enough in the banks on a mark-to-market basis to cover withdrawals. They knew this through all of last year, and communicated it internally in their coded language.

It's obvious from the graphs (see linked). The central banks, the banks, and the banking regulators all knew a huge crash was coming — the phrase is "unrealized losses". But they never notified you, the depositor.

Instead the regulators allowed banks to hide their literal insolvency in footnotes, until one guy figured it out.

So anyone who bet on long-term Treasuries got killed in 2021. And now, anyone who bets on short-term Treasuries is going to get killed in 2023. The absolute worse place you can be is to have large amounts of assets locked up in three month treasury bills. The ~5% interest rate offered by big banks (G-SIBs) is a trap. Most fiat bank accounts are now a trap, for those countries whose central bankers followed the Fed.

Remember how no masks was “science” and then total masking was too? Similarly, zero rates were “economics” and then suddenly high rates were too.

There’s no check and balance. Sales guy misses a forecast on a million dollars, he has no job. But the Fed guy misses a forecast on a trillion dollars, and he has no accountability.

They jerked rates up and down so hard that they have finally crashed the entire US banking system, with consequences for every dollar holder worldwide.

To summarize elements of Balaji’s argument:

1) The Fed's rate hikes caused SVB's collapse.

2) The central bank caused the insolvency of hundreds of banks, the banks hid this with accounting, and the bank regulators let them do this.

3) This means the entire US banking system is fundamentally untrustworthy on a deep level.

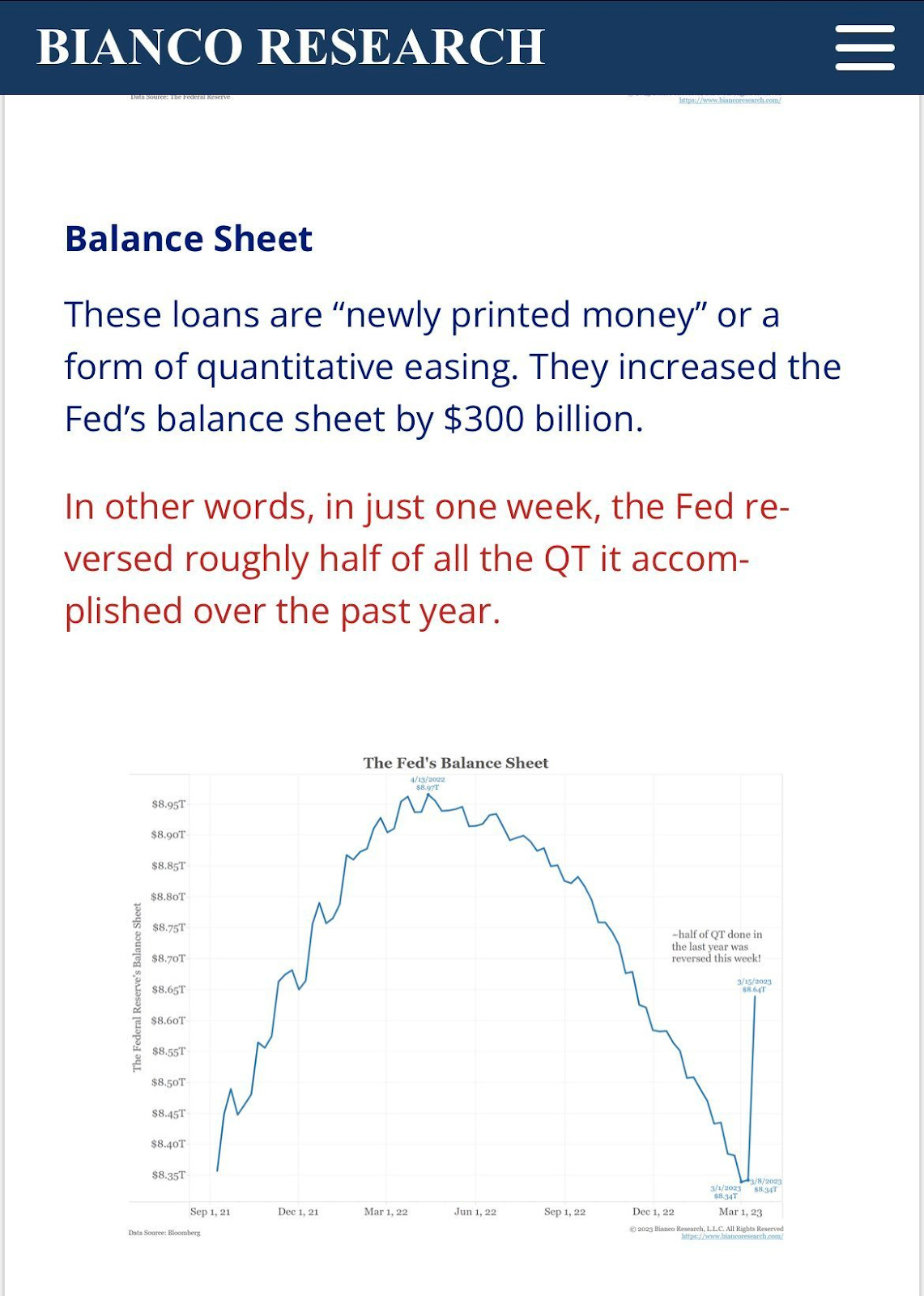

The Fed is printing trillions while hiking rates, because they have rolled out programs that have broken the traditional relationship between high rates and tighter monetary policy.

According to Balaji, there are two responses to the banking crisis.

1) Move all your money to big banks or money market funds as a “flight to safety”. In the latter they are using custodian banks + reverse repo to effectively centralize the funds with the Fed. In the former people are relying on the too big to fail (TBTF)—that the big banks will always get printed money to get bailed out. After the chaos, all the money is centralized in a few giant banks and mutual funds

2) The other option is to exit the US banking system entirely. Get as far away as you can from blue states and blue coins. And most importantly moving to Bitcoin and assets that the Fed can't simply freeze or seize or inflate.

Or put more poetically like Balaji here:

OK so there are a million technical details that one can quibble over and many people have, so I’m only going to focus on broad contours of the pushback in this piece. It’s safe to say BTC isn’t going to $1M. It’s unclear whether it will rise at all. So let’s look at Balaji’s broader claim about the fragility of the financial system, specifically his claim that we’ll experience hyperinflation.

It seems apparent, and Balaji called this early, that some regional banks will fail. This isn’t all that bad however. Even if hundreds of banks fail, it would be well within the history of the US experience — 20% of banks failed during the S&L crisis, and the system didn’t collapse.

It’s worth noting, however, that bank failures are usually deflationary. It’s important to distinguish what’s happening now from quantitive easing (QE). QE is printing money and buying bonds — and thereby suppressing natural market interest rate. The current balance sheet expansion is basically repo: The Fed prints, and loans money against collateral, and the bank uses the money to fund deposit outflows to another bank. This doesn’t expand the money supply. The bank now has a worse liability structure, because it lost deposits and replaced it with Fed funding. Which means the bank needs to contract their lending book. So this is credit contractionary and disinflationary, which is why the bond market is pricing it as such. Even if the Fed keeps rolling funding, the behavior of banks with a weak funding structure is to contract lending - which leads to a credit crunch and decline in related asset values (like CRE).

Japan is actually an interesting case study for this. Japanese banks have been zombies for decades because of this issue, and has resulted in decades of minimal inflation/deflation despite a huge expansion in the central bank balance sheet. You can have large central bank balance sheet expansion and still have no inflation. How? Because velocity of money collapses. It’s obviously bad for the economy, but not because it leads to massive inflation, in anything it leads to the opposite.

Balaji is referring to $500B that was taken out of banks to demonstrate that banks have lost trust, but most of that money has stayed in the country whether in money markets or treasuries.We’ve seen in countries like Argentina where money fled the country and you had the triple whammy of capital flight, recession and inflation — currency tanks as money flees (capital flight), banks stop lending (credit contraction), and central bank prints to defend FX / fund gov’t budget (i.e. inflation).

Balaji quotes Ray Dalio that we will have to print to monetize the debt, just like all countries with high debt/GDP do. I think this will be the legacy of his bet, the part that he’s right about—predicting that the U.S. will have more inflation than we think, and that there’s more fragility in the financial system than we think. I covered the Dalio argument in a previous piece. Quoting here:

If we think about business cycles, debt accumulates until a recession, which forces deleveraging, and then debt accumulates again upon recovery. This is the short-term business cycle. But since the debt/GDP ratio doesn't get back to previous levels, interest rates fall to 0, then comes quantitative easing, and then more fiscal policy. At some point, you start to run out of ways to deleverage. That is the long-term business cycle.

This puts us in a position to have an inflationary outcome and possibly a currency devaluation, which often go hand in hand.

Low interest rates mean you can have a high debt/GDP ratio while still paying interest on that debt. But high interest rates create systemic economic fragility, to the point where mass-insolvency becomes a national security issue — a perfect example being the bankruptcy of small businesses during Covid.

It seems the only way out of this is via inflation: whenever sovereign debt to GDP has reached over 130%, 51 out of 52 times that debt was not paid back in real terms, meaning there was inflation.

There’s a broader question that overhangs this debate, and is central to Balaji’s thesis that we’ll experience indefinite inflation: how will the U.S. pay back its debt?

While many Bitcoiners have smart critiques of the status quo, what they don’t appreciate is that absolute debt levels don't matter. What matters is relative debt levels: the size of debt relatively to your ability to service it. Yes, interest could cost a trillion dollars, but if you can service it with growth, you can continue to pay it off. As long as the national economy is growing at a faster rate, you can take on more and more debt, and the debt just rolls over forever.

What people don’t understand is that you want some moderate level of inflation (2-3%) because you want people to use money to trade and invest, and not just hoard. If inflation is 0% or lower, you get hoarding, and trade and investment are stunted, which leads to recessions. So you want people to not hoard money and instead get it out into the world buying goods and services and investing in businesses.

What happens after a century of 2-3% annual inflation? Well, the currency inflates to near worthlessness compared to what it was a century before, but what you get for that is all of the goods and services and trade and investment over that century. And that’s the story of our growth these past couple centuries.

There's always been a strong contingent pushing back against fiat currency, and advocating for hard metal currency instead (gold), and then later for "sound money" i.e. paper money that is managed to not inflate—or digital currency like Bitcoin. Bitcoiners have adopted the gold theory of economics.

Interestingly, Bitcoiners are correct on a number of details . A fiat system discourages saving. But a deflationary system discourages spending and investing. It’s worth noting that there are always tradeoffs: When money was gold and silver for example, and there was only so much of it, people would just hoard it. In a fiat system, you want people to spend and invest. The dollar can’t hyperinflate precisely because it's the enabler of global trade. If the dollar shoots, every other currency goes along with it. This is Brent Johnson’s Dollar Milkshake theory. It is certainly possible that one day, another currency replaces the dollar as the global reserve currency and the basis for international trade. But it's not going to be the Euro, the RMB, or the Japanese Yen. It could be a digital currency someday, but it would have to be a very big, very stable, very liquid one, and we’re a long ways away from that.

So yes, Bitcoiners are accurate in some of their critiques. The value of paper currency does inflate away. The debt is never going to get paid back. There is in fact danger to running a country like this if you're not the global reserve currency. There is even some danger to running a country like this even if you *are* the global reserve currency — if you push it too far, you might lose your status as the global reserve currency and then be in trouble.

That said, a banking crisis, in this country, at this time, with the choices people have, is not going to result in hyperinflation and collapse. Not in the next 90 days, not in the next few years.

Balaji’s specific bet might be more reasonable if the U.S. were an emerging market (EM) like Argentina. But because U.S. is a global reserve currency, it can get away with a lot of challenges that an EM cannot. Central to Balaji’s view is that the U.S. will lose global reserve currency status and thus act like any other country facing a currency crisis. He believes that the money fleeing banks will go to BTC or RMB instead of staying within the country. He concedes that if you don’t believe this is possible, his case for massive inflation won’t make as much sense.

So the real question is how much longer can the U.S. be the global reserve currency (GRC), and what needs to be true for America to lose our GRC status. After all, dollars were one 40% of global GDP, now they’re closer to ~15-20%, so dropping even further is not crazy. It’s possible everything depends on that. Because that’s what Balaji’s best predictive skill is — realizing when an assumption we took for granted has now changed, and extrapolating second-order effects out from that change. Let’s hope, as he does, that he isn’t right this time.

Thanks to anonymous and anonymous for greatly contributing to this piece

Good nuanced take Erik. Balaji raised another point: modern technology amplifies panic and herd behavior. This in turn precipitates loss of confidence effects.

In this light, it is useful to run a scenario: when large holders of US long term treasuries and US government guaranteed mortgage-backed bonds start to sell their holdings because they believe they will be sitting on permanent losses. What happens to the equity of banks, insurance companies and pension funds ? What happens to institutions or sectors that rely on these financial institutions? What happens to real estate valuations and what effects do they have on consumption and investment?

The abandonment of the US reserve currency status may happen relatively quickly because of large scale loss of confidence. Gold as an easy alternative for other central banks and for large financial institutions is freely available and can become an alternative reserve currency quickly. All that is needed is the beginning of a collective shift in belief that gold is more trustworthy than the US government/Fed.

Balaji lost me when he said we'd all become seasteaders and land won't matter for the rule of law anymore. This seems to pile on to his growing cognitive disconnect with reality.