Why Growing the Startup Economy Matters

In a previous post On Economic Growth, I made the case for why growing the economy is a moral imperative. Since economic growth is positively correlated with almost everything we care about — from lifting people out of extreme poverty to improving life expectancy to overall life satisfaction — it’s something that should matter deeply to us if we care about moving humanity forward.

But this begs the question: what can we do to increase economic growth? I would argue that the single biggest source of economic growth is the Startup Economy, and that growing the Startup Economy is one of the most important things we can do to build a better future.

The Startup Economy is the sum total of all the economic value produced by fast-growing, innovative companies and the problems they solve. This includes the jobs that startups create, the services they use in their day-to-day operations, the support services that help create and fund them, and their direct economic activity.

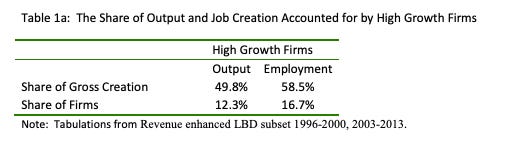

Defined in this way, startups alone contribute an estimated $3.8 trillion per year to global GDP; in the US, startups contribute disproportionately to job creation and economic growth given their collective size relative to the rest of the economy. Though startups account for only about 10% of US companies, more than 20% of job creation in a typical year is generated from startups. Most startups fail, but if a startup survives, it is likely to have higher average net output growth and productivity growth than its more mature counterparts.

In addition to creating most net-new economic activity, startups solve problems in ways that big corporations or governments can’t. Often, startups are the first to come up with the best solutions for the world’s most pressing problems (from healthcare to financial inclusion to new energy sources)

There are ways to solve these problems that don’t involve startups, but in comparison, these big corporate or government or regulatory solutions tend to be poorer quality, more inefficient, take longer to implement, and/or involve some form of (legislative) coercion to accomplish.

Instead of coercing a consumer to do the right thing, startups can create new solutions that align consumer preferences with the public good. Startup-driven solutions to global challenges therefore often provide an option that makes the consumer and the world better off without incurring the costly trade offs and unintended consequences that often come with policy-driven solutions, or the wasteful inefficiency that typically plagues large organizations attempting to innovate.

For example, take climate change. The traditional solution to climate change is to implement carbon taxes and agreements to limit carbon emissions. These fail because of collective action problems (carbon-emitting industries can just move to non-treaty-abiding countries).

The startup solution to climate change, on the other hand, was Tesla. Tesla proved effective in fighting climate change because it provided an alternative to greenhouse-gas-emitting vehicles that was a better product on its own merits, thereby aligning consumer self-interest with a larger problem we need to collectively solve. No one has to sacrifice by driving a Tesla. In fact, a Tesla is a better car than its ICE counterparts.

Because of their disproportionate impact on driving solutions to big problems, creating new jobs, and economic output, it seems clear that the best way to increase economic growth is to increase the number of successful startups in the world.

But although the Startup Economy is a critical driver of growth, individual startup outcomes can be highly varied. They follow a power law; many startups end in outright failure, while a small minority achieve immense success which transforms the economy and drives growth.

The individual risk-taking by founders therefore benefits society as a whole. As Nassim Taleb put it in a chapter of Antifragile entitled “What Kills Me Makes Others Stronger”,

“The fragility of every startup is necessary for the economy to be antifragile, and that’s what makes, among other things, entrepreneurship work: the fragility of individual entrepreneurs and their necessarily high failure rate.”

Startups are the guinea pigs of capitalism; the part of the economy we devote to experimenting and trying new things. Most startups fail in their first few years, but sometimes the experiments work and the results are transformative.

There is no natural limit on the amount of successful startups. What could be done to significantly grow the Startup Economy.

How to grow the Startup Economy

The economy in general, and the Startup Economy in particular, are complex adaptive systems.

We tend to succumb to the high-modernist urge to try and engineer complex adaptive systems to create regular, predictable outcomes. This urge is a mistake: complex systems are by nature ill-suited to being forced into predictable, linear systems.

The key to influencing a complex system is to view the system holistically. Instead of trying to engineer the outcomes, we should focus on setting better initial conditions so that more of the outcomes we want can unfold naturally.

With that said, there are three critical “inputs” that go into the system of the Startup Economy:

Builders. These are people with the ability and willingness to solve problems. Founders take capital and use it to build solutions for customers. Without builders taking capital and creating solutions to customer problems, we don’t get new solutions, and the Startup Economy doesn’t grow.

Capital. Capital is money looking for return by financing builders. Founders need capital in order to hire employees, buy equipment and build solutions to problems their customers have.

Customers. Customers are people with problems who are willing to pay for solutions to their problems.

Increasing these inputs is likely to lead to an increase in the size and productivity of the ecosystem in the long term

For example, whenever a builder gets matched with capital and creates a solution to a customer’s problem that they are willing to pay for, we get the building blocks of economic activity that come together to make up the broader Startup Economy.

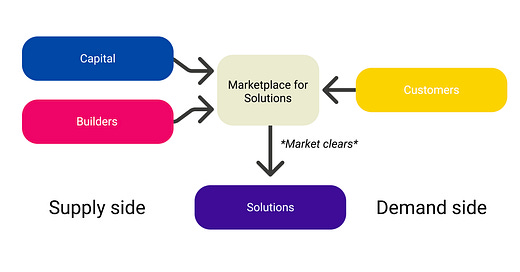

Charles Cushing’s excellent piece “How can we fix the Market for Solutions” offers a potent framework for how to think about the startup ecosystem in terms of inputs and outputs using a traditional marketplace network model with a supply side and demand side:

On the supply side of the “marketplace for solutions”, you have two inputs: capital and builders. On the demand side are customers who want those solutions. Solutions themselves are the outputs.

If this is a valid framework, it implies that there are two possible ways to grow the marketplace for solutions (i.e. the Startup Economy) as a whole:

Increase the inputs by increasing A) the amount of capital, B) the number of builders, and/or C) the number of customers participating in the startup ecosystem.

Increase the amount of interactions, connections, and relationships between various marketplace participants.

Another way to look at it: if the Startup Economy is a giant network, then the best way to grow it is to either grow the number of nodes in the network or the number of connections between those nodes.

To get more specific, let’s take a look at how to grow each marketplace component individually.

How to get more capital into the Startup Economy

There are two main ways to increase the supply of capital in the marketplace of solutions:

Easing regulation that constrains the pool of possible investors

Making startup investments more liquid

Better match startups and investors

Regulations currently make it harder to invest in startups than to invest in public equities. To invest in startups, you have to be an accredited investor, which only a small percentage of American households are. The accredited investor requirement limits the amount of capital available to builders. Loosening the accredited investor requirement could increase the capital available to startups.

Additionally, startup investments are not very liquid. It is significantly more difficult to trade your startup equity for cash than it is for public company equities. The relative illiquidity of startup investments discourages people from investing in startups. Enabling more liquidity by creating more vibrant secondary markets for startup investments would encourage more capital to flow to builders.

Accessibility and curation matters as well. Investing in publicly-traded companies can be done on an app on your phone, but the best startup investments often require that you be immersed in the Silicon Valley ecosystem even to have a chance at investing in a given deal. The development of platforms like AngelList and rolling funds make it more legible to invest in builders. Data tools are making it easier for founders and investors to find each other. However, we still have a long way to go before startup investments reach parity with other asset classes.

How to increase the global supply of builders

There are a few different ways to increase the supply of builders in the Startup Economy. These include:

Helping people find the right startup ideas

Making it easier to find a co-founder

Helping potential founders solve immigration challenges

Encouraging more people to become builders & expanding internet access globally

Helping people find customers

Helping founders get healthcare

Building out communities of founders

Redefining the default path for ambitious people to include starting a startup

Many potential founders never start because they don't understand the "rules of the game" for creating a startup. They don't know how to raise capital, build a product, or find their first ten customers. Additionally, they rarely have a community of fellow founders to learn best practices with. Building founder communities that help founders support each other with knowledge, connections, and friendship can increase the supply of founders.

Another direct way to increase the supply of potential founders is to help founders immigrate to areas with more opportunity and economic freedom. This can be through helping with immigration by sponsoring immigrant petitions, helping secure visas, or assisting with Green Card applications. If you help founders immigrate to the United States or areas with more opportunity and economic freedom, they are more likely to become founders. But also we need to help founders build companies wherever they happen to be. Among other things, we need to expand internet access: 37% of the world has never used the internet before, locking out a full third of the human population from the Startup Economy. Technologies like Starlink can help increase the supply builders by expanding cheap, high-quality internet to remote parts of the world where it was previously unavailable.

Additionally, you can increase the supply of builders by simply encouraging more people to become founders and reassuring them that they do have the ability to start a successful company. Giving builders belief capital to do something extraordinary can be the difference between success and never even trying. As Scott Alexander puts it:

“Most people don't accomplish great things because they don't try to accomplish great things, because they don't think of themselves as the kind of person who could achieve great things.”

Encouraging more talented people to take the leap, and become a founder can greatly increase the supply of builders.

Along those same lines, building should become the default path for ambitious people. Some of the most talented and ambitious potential builders are currently trapped working on suboptimal problems. The best scientists are in academia, the best operators are stuck in large consultancies, and the best engineers are stuck at FAANG. If we can make building the default path, this redirects potential founders from working on suboptimal problems and directs them into the Startup Economy.

Once people start to build businesses, we need to make it easier for them to get startup ideas. The startup ecosystem has countless people exploring similar idea mazes, and yet they’re siloed, starting from scratch. They should be building on top of each other, helping each other understand where the bodies are buried & where the opportunities are. Imagine a world where we had decks, post-mortems, etc on all startups. Founders would avoid minefields, build on other people’s ideas, & better navigate idea mazes. In short, we'd have so much more innovation. And yet we don't, because people pursue local maxima at expense of global maxima

Then we also need to make it easier for people to find co-founders. We’re still in the pre-dating app stage, where people focus on finding co-founders in their immediate proximity.

How to get more customers to participate in the Startup Economy

It’s always challenging for startups to reach customers and find the correct problem to solve, which is why getting to product-market fit is such an obsessive focus early on. It’s also why billions of dollars a year are spent on marketing.

Increasing the supply of customers with problems they are willing to pay for entails finding new ways to make customers' problems more legible. For example, we could envision Kaggle-like competitions that encourage potential customers to put up bounties for problems they need solved, which could serve as a better signal for founders about what they should work on.

Another angle is to create directories of the world's most pressing challenges and list potential solutions to those challenges. Builders that have difficulty creating something people want are often not working on ambitious enough problems.

For example, you don't have to guess whether or not someone will pay for a cure for their terminal illness. By listing out the most pressing challenges facing humanity, you can help builders focus on problems worth solving and increase the supply of customers in the Startup Economy.

Some examples of projects like this include Rethink Priorities and Open Philanthropy; more visibility for projects like these might go a long way to focusing founders on building the most needed solutions.

How to foster greater connectivity within the startup ecosystem

If you can better match capital with builders and builders with problems, it’ll result in a higher velocity of solutions and accelerate the growth of the Startup Economy. This can be accomplished by increasing coordination at the intersection of capital, talent, and ideas.

Currently, matching builders with customers incurs high transaction costs. One one hand, it’s often difficult for capital to find builders to fund and builders to find capital. Meanwhile, it’s hard for customers to find solutions to their problems, and it is hard for builders to find problems to solve.

The way to solve this is by lowering the transaction costs of connecting builders with capital and customers, which can be accomplished in several ways.

Build startup programs that programmatically source top builders, while also sourcing capital for those builders and helping them find their first customers.

Build highly legible communities that encourage builders to make their goals and aspirations public, investors to make their theses public, and give customers incentives to signal the solutions they’re looking for.

Finally, robust communities in the startup ecosystem can also help lower transaction costs by improving information flows. Currently, information is unevenly distributed in the Startup Economy, leading to low matching efficiency. The more open and transparent the global startup ecosystem becomes, the faster the Startup Economy will grow.

The success of our economy depends on the Startup Economy

In summary, growing the Startup Economy is critical to our long-term success. The Startup Economy is the highest leverage point we have to increase economic growth, and it must become a renewed focus of our effort and resources.

The best way for us to grow the startup economy is to increase the amount of capital, the numbers of builders, the number of customers–and the amount of successful relationships between all the participants. The main things holding us back are merely our imagination, our ambition, and our ability to coordinate accordingly.

Thanks to Sachin Maini and Will Jarvis for co-writing.

Brilliant write up. Gives a systems view of the entire start-up ecosystem.

One of your best essays all time, great work. Your worldview continues to inspire me!